Cornish Metals Inc. (TSX-V/AIM: CUSN) (“Cornish Metals” or the “Company”), a mineral exploration and development company focused on its projects in Cornwall, United Kingdom, is pleased to announce that it has released its unaudited financial statements and management, discussion and analysis (“MD&A”) for the three months ended April 30, 2023. The reports are available under the Company’s profile on SEDAR and on the Company’s website.

Highlights for the three months ended April 30, 2023 and for the period ending June 21, 2023

(All figures expressed in Canadian dollars unless otherwise stated)

- Drill program nearing completion at South Crofty to collect samples for metallurgical testwork as part of the Feasibility Study, with drilling expected to be finished by the end of June 2023;

- Construction of the water treatment plant (“WTP”) substantially complete with commencement of dewatering expected later in summer 2023 at a construction cost estimated to be between £6.5 million and £7.0 million ($11.1 million and $11.9 million at quarter end exchange rate);

- First submersible pump currently being installed in New Cook Kitchen’s ("NCK") shaft with the second pump expected to commence installation by the end of June 2023;

- Two single drum winders have been ordered for the shaft re-access work, with the main winder due on site in October 2023 and the emergency winder due for delivery in August 2023;

- Remedial work underway on the south headframe above NCK shaft in readiness for the installation of the main winder;

- Work on the Feasibility Study continues with completion planned by the end of 2024; and

- Further digitization of historic assay information and data from the metallurgical drilling program is being incorporated into an updated Mineral Resource Estimate with a targeted release date for the end of September 2023.

Richard Williams, CEO of Cornish Metals, stated, “It is just over a year since the £40.5m financing led by Vision Blue Resources completed, and we are pleased with the excellent progress that has been made during this time. Dewatering of the mine is on track for commencing later this summer and other aspects of the project are well underway.

“With the completion of the metallurgical drill programme this month, we look forward to continuing the exploration programme of the Wide Formation at Carn Brea in the coming weeks to demonstrate the Mineral Resource potential of this target.”

Financial highlights for the three months ended April 30, 2023 and April 30, 2022

|

|

Three months ended (unaudited) |

|

|

|

April 30, 2023 |

April 30, 2022 |

|

(Expressed in Canadian dollars) |

|

|

|

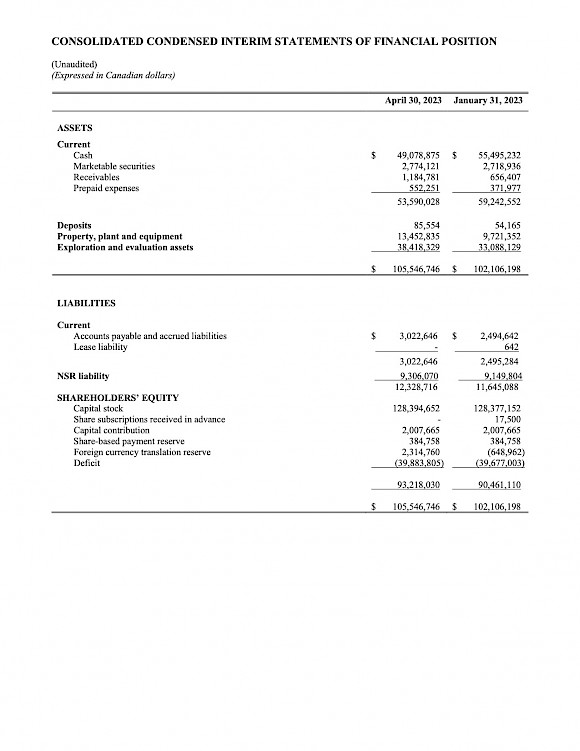

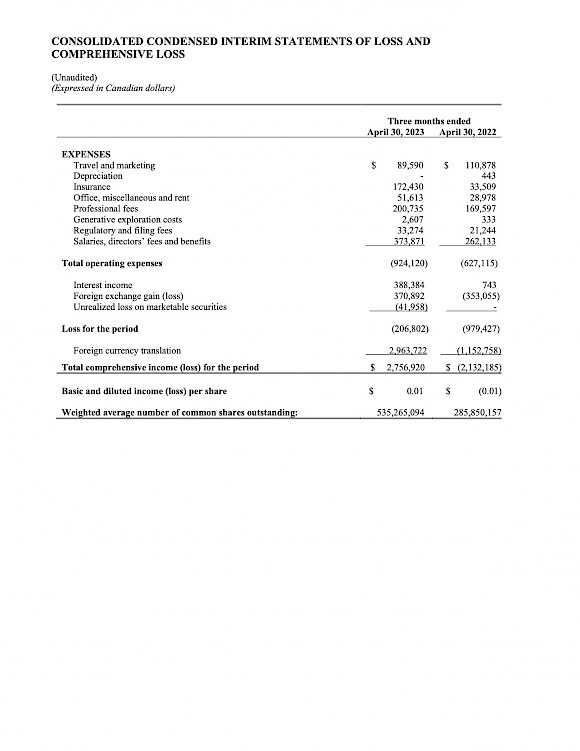

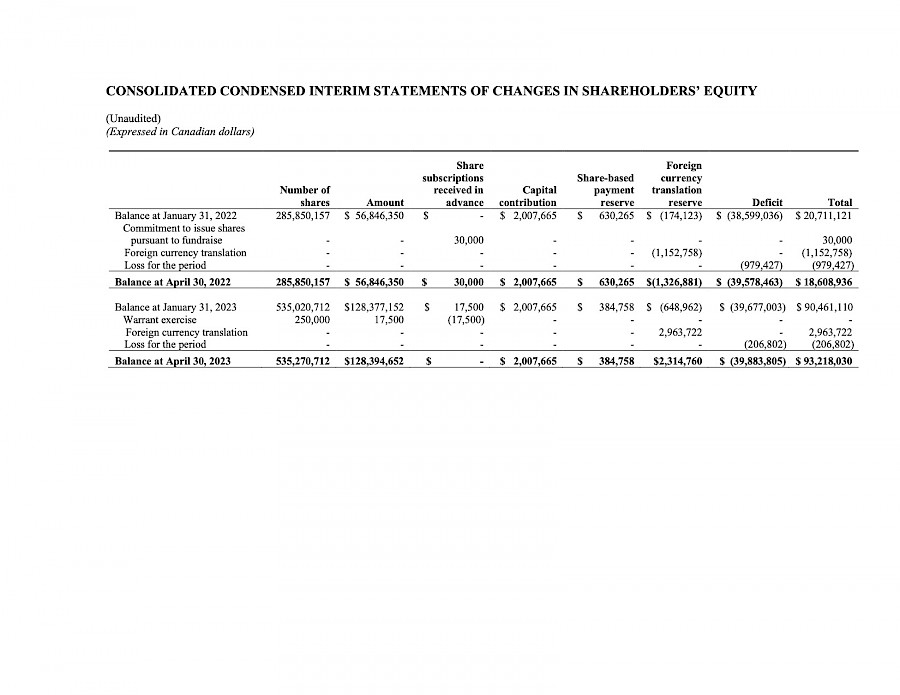

Total operating expenses |

$924,120 |

$627,115 |

|

Loss for the period |

$206,802 |

$979,427 |

|

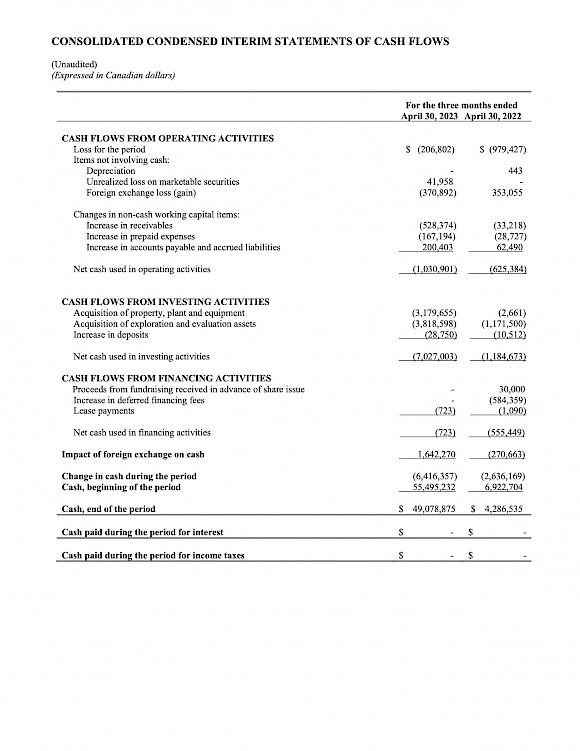

Net cash used in operating activities |

$1,030,901 |

$625,384 |

|

Net cash used in investing activities |

$7,027,003 |

$1,184,673 |

|

Net cash used in financing activities |

$723 |

$555,449 |

|

Cash at end of the period |

$49,078,875 |

$4,286,535 |

- Increase in operating costs impacted by higher insurance costs attributable to more site-based activities primarily relating to the construction of the WTP and related dewatering work;

- Expenditure of $3.4 million incurred during the period on the construction of the WTP and related dewatering equipment, as well as new or replacement equipment for the mine;

- Other project related costs of $3.4 million incurred during the period relating to the advancement of South Crofty to a potential construction decision, primarily for the metallurgical drill program and planning activities for dewatering and shaft re-access;

- Interest income of $388,384 arising from increased interest rates being received on higher cash balance following the Offering; and

- Recognition of foreign currency translation gain of $3.0 million for those assets located in the UK when translated into Canadian dollars for presentational purposes.

Construction progress of water treatment plant at South Crofty

- Construction progress of the WTP at South Crofty has included various enabling works, including completion of the treated water discharge duct from the WTP and the concrete foundation pad for the WTP itself. The pipelines carrying water from the submersible pumps in NCK shaft to the WTP are also complete;

- The WTP comprises nine reaction tanks for increasing and decreasing the pH to precipitate the various metals in solution, and six inclined plate settling tanks (lamella clarifiers) to remove the precipitated solids. All the tanks and clarifiers have been installed, as have the structural steel supports and walkways which provide access to the WTP;

- The installation of mechanical, electrical and instrumentation equipment is expected to be completed in the first half of August 2023. Reagent storage, make-up and dosing equipment have been supplied as complete packages from specialist manufacturers;

- The building housing the high voltage power supply/sub-station and the variable speed drives required to operate the pumps is complete, and the 11kV power supply is scheduled to be in place by the end of June 2023. A turbine will be added ahead of the discharge point that will generate up to 15% of the electricity required to operate the WTP;

- Wet commissioning of the WTP is expected to commence in August 2023, with commencement of mine dewatering expected shortly thereafter; and

- Overall, the cost of construction for the WTP is expected to be between £6.5 million and £7.0 million ($11.1 million and $11.9 million at quarter end exchange rate).

Outlook

The proceeds raised from the Offering completed in May 2022 are being used to advance the South Crofty tin project to a potential construction decision within 30 months from closing of the Offering. The planned use of the proceeds from the Offering is to complete the dewatering program and Feasibility Study at South Crofty, evaluate downstream beneficiation opportunities and commence potential early works on-site in advance of a potential construction decision.

Within 30 months from the closing of the Offering, the Company’s plans are as follows:

- Construct WTP and commence dewatering during summer 2023 and thereafter complete the dewatering of the mine within 18 months;

- Complete a drill program for metallurgical studies and to produce an updated JORC (2012) compliant Mineral Resource estimate for a Feasibility Study;

- Complete a Feasibility Study using all reasonable commercial efforts by the end of 2024; and

- Commence basic and detailed engineering studies, construction of the processing plant, refurbishment of underground facilities and other on-site early works.

- A follow up drill program is also being planned to determine the continuity of mineralization and to better define the geometry and extent of the Wide Formation at Carn Brea. This follow-up program is expected to commence at the beginning of July 2023, as soon as the metallurgical drill program as described above is completed.

Subject to the availability of financing, consideration will also be given to continuing with the Company’s exploration program at United Downs and evaluating other near-surface, high potential, exploration targets within transport distance of the planned processing plant site at South Crofty.

ABOUT CORNISH METALS

Cornish Metals completed the acquisition of the South Crofty tin and United Downs copper / tin projects, plus additional mineral rights located in Cornwall, UK, in July 2016 (see Company news release dated July 12, 2016). The additional mineral rights cover an area of approximately 15,000 hectares and are distributed throughout Cornwall. Some of these mineral rights cover old mines that were historically worked for copper, tin, zinc, and tungsten.

TECHNICAL INFORMATION

The technical information in this news release has been compiled by Mr. Owen Mihalop. Mr. Mihalop has reviewed and takes responsibility for the data and geological interpretation. Mr. Owen Mihalop (MCSM, BSc (Hons), MSc, FGS, MIMMM, CEng) is Chief Operating Officer for Cornish Metals Inc. and has sufficient experience relevant to the style of mineralisation and type of deposit under consideration and to the activity which he is undertaking to qualify as a Competent Person as defined under the JORC Code (2012) and as a Qualified Person under NI 43-101. Mr. Mihalop consents to the inclusion in this announcement of the matters based on his information in the form and context in which it appears.

For additional information please contact:

In North America:

Irene Dorsman at (604) 200 6664.

In UK:

SP Angel Corporate Finance LLP Tel: +44 203 470 0470

(Nominated Adviser & Joint Broker) Richard Morrison

Charlie Bouverat

Grant Barker

H & P Advisory Limited Tel: +44 207 907 8500

(Joint Broker) Matthew Hasson

Andrew Chubb

Jay Ashfield

BlytheRay Tel: +44 207 138 3204

(Financial PR/IR-London) Tim Blythe tim.blythe@blytheray.com

Megan Ray megan.ray@blytheray.com

ON BEHALF OF THE BOARD OF DIRECTORS

“Richard D. Williams”

Richard D. Williams, P.Geo

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Caution regarding forward looking statements

This news release contains "forward-looking statements" including, but not limited to, statements in connection with the expected use of proceeds of the Offering, including in respect of certain work programs, expected construction, including in respect of the WTP, and the potential completion of a Feasibility Study on the South Crofty mine and the timing thereof, the exploration program at United Downs and other exploration opportunities surrounding the South Crofty tin project, expected recruitment of various personnel, and expectations respecting tin pricing and other economic factors. Forward-looking statements, while based on management’s best estimates and assumptions at the time such statements are made, are subject to risks and uncertainties that may cause actual results to be materially different from those expressed or implied by such forward-looking statements, including but not limited to: risks related to receipt of regulatory approvals, risks related to general economic and market conditions; risks related to the COVID-19 global pandemic and any variants of COVID-19 which may arise; risks related to the availability of financing when required and on terms acceptable to the Company and the potential consequences if the Company fails to obtain any such financing, such as a potential disruption of the Company’s exploration program(s); the timing and content of upcoming work programs; actual results of proposed exploration activities; possible variations in Mineral Resources or grade; failure of plant, equipment or processes to operate as anticipated; accidents, labour disputes, title disputes, claims and limitations on insurance coverage and other risks of the mining industry; changes in national and local government regulation of mining operations, tax rules and regulations.

Although Cornish Metals has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking statements, there may be other factors that cause results not to be as anticipated, estimated or intended. There can be no assurance that such statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking statements. Cornish Metals undertakes no obligation or responsibility to update forward-looking statements, except as required by law.

Market Abuse Regulation (MAR) Disclosure

The information contained within this announcement is deemed by the Company to constitute inside information pursuant to Article 7 of EU Regulation 596/2014 as it forms part of UK domestic law by virtue of the European Union (Withdrawal) Act 2018 as amended.