Related Document

Cornish Metals Inc. (TSX-V/AIM: CUSN) (“Cornish Metals” or the “Company”), a mineral exploration and development company focused on its projects in Cornwall, United Kingdom, is pleased to announce that it has released its unaudited financial statements and management, discussion and analysis (“MD&A”) for the three months ended April 30, 2022. The reports are available under the Company’s profile on SEDAR (www.sedar.com) and on the Company’s website (www.cornishmetals.com).

Highlights for the three months ended April 30, 2022 and for the period ending June 22, 2022

(All figures expressed in Canadian dollars unless otherwise stated)

- Completion of 10,159 meters of drilling within phased exploration program at the United Downs exploration project with results from first 3,927 meters of drilling reported to date, with further assay results to be reported when available;

- Completion of financing for gross proceeds of £40.5 million ($64.8 million based on closest available exchange rate) (the “Offering”), including a strategic investment by Vision Blue Resources of £25.0 million ($40.0 million), to advance the South Crofty tin project (“South Crofty”) to a potential construction decision (news releases dated March 27, 2022 and May 23, 2022);

- Issuance of second tranche of common shares pursuant to the restructuring of the deferred consideration relating to the acquisition of the South Crofty tin project and associated mineral rights (news release dated May 29, 2022); and

- Mr. Tony Trahar nominated by Vision Blue Resources as its representative on the Board (news release dated June 5, 2022).

Richard Williams, CEO of Cornish Metals, stated, “The completion of the £40m financing including a strategic investment by Vision Blue Resources last month opened a new chapter for the Company. As soon as the funds were received at the end of May, we wasted no time in starting to place orders for the new water treatment plant. The first recruits to our newly formed projects team will be joining us in the coming weeks and further appointments will be made to our mining and geological teams to enhance their capacities.

The next few months will be hard but rewarding work as we build the required framework for strong and capable project execution. I look forward to reporting on progress at South Crofty in due course.

In the meantime, the backdrop for tin pricing in the medium to long term remains favourable. Demand is expected to increase further as electrification gathers pace, with supply constraints showing no sign of abating.”

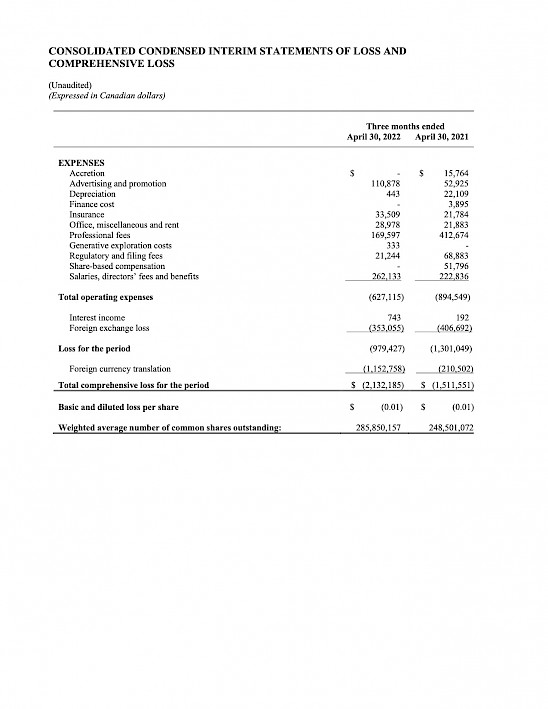

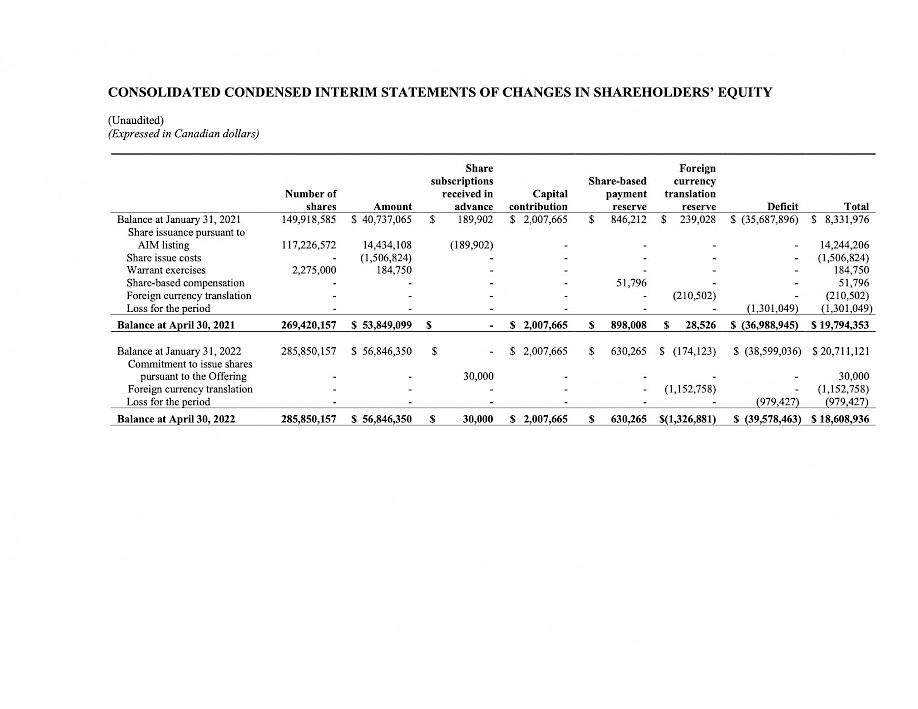

Financial highlights for the three months ended April 30, 2022 and April 30, 2021

|

|

Three months ended (unaudited) |

|

|

|

April 30, 2022 |

April 30, 2021 |

|

(Expressed in Canadian dollars) |

|

|

|

Total operating expenses |

627,115 |

894,549 |

|

Loss for the period |

979,427 |

1,301,049 |

|

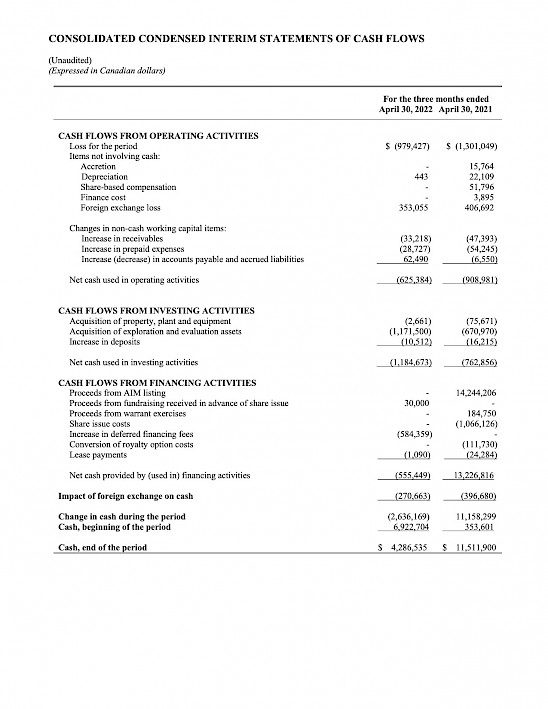

Net cash (used in) operating activities |

(625,384) |

(908,981) |

|

Net cash (used in) investing activities |

(1,184,673) |

(762,856) |

|

Net cash (used in) / provided by financing activities |

(555,449) |

13,226,816 |

|

Cash at end of the period |

4,286,535 |

11,511,900 |

- Decrease in operating expenses impacted by $368,325 of costs relating to AIM listing incurred in comparative period which were not eligible for capitalization;

- Higher operating expenses more generally relating to increased media/investor activities following last year’s AIM listing and preparatory work for the successful fundraise cornerstoned by Vision Blue Resources;

- Costs of $576,786 and $230,723 capitalized in connection with the ongoing exploration program at United Downs and Carn Brea, respectively (excluding capitalized depreciation and other non-cash items);

- Financing fees of $584,359 incurred by April 30, 2022 in connection with the fundraise which closed at the end of May 2022;

- Gross proceeds raised from the Offering of £40.5 million ($64.8 million) received subsequent to the period end, following gross proceeds raised from the AIM listing in comparative period of £8.2 million ($14.4 million) (news release dated February 16, 2021); and

- Recognition of foreign currency translation loss of $1,152,758 for those assets located in the UK when translated into Canadian dollars for presentational purposes.

Outlook

The proceeds raised from the Offering completed in May 2022 are being used to advance the South Crofty tin project to a potential construction decision within 30 months from closing of the Offering. The planned use of the proceeds from the Offering is to complete the dewatering program and Feasibility Study at South Crofty, evaluate downstream beneficiation opportunities and commence potential on-site early works in advance of a potential construction decision.

Within 30 months from the closing of the Offering, the Company’s plans are as follows:

- Construct the Water Treatment Plant (“WTP”) in the first half of 2023 and thereafter complete the dewatering of the mine within 18 months;

- Complete an underground drill program which is expected to commence in July 2022 in order to delineate a JORC compliant Measured and Indicated Mineral Resource and increase the Indicated and Inferred JORC Mineral Resource once access to the underground workings is obtained;

- Complete a Feasibility Study using all reasonable commercial efforts on or before 31 December 2024;

- Commence basic and detailed engineering studies, construction of the processing plant, refurbishment of underground facilities and other on-site early works; and

- Evaluate downstream beneficiation opportunities in the UK and the rest of Europe.

Subject to the availability of financing, consideration will also be given to continuing with the Company’s exploration program at United Downs and evaluating other near-surface, high potential, exploration targets within transport distance of the planned processing plant site at South Crofty.

ABOUT CORNISH METALS

Cornish Metals completed the acquisition of the South Crofty tin and United Downs copper / tin projects, plus additional mineral rights located in Cornwall, UK, in July 2016 (see Company news release dated July 12, 2016). The additional mineral rights cover an area of approximately 15,000 hectares and are distributed throughout Cornwall. Some of these mineral rights cover old mines that were historically worked for copper, tin, zinc, and tungsten.

TECHNICAL INFORMATION

The technical information in this news release has been compiled by Mr. Owen Mihalop. Mr. Mihalop has reviewed and takes responsibility for the data and geological interpretation. Mr. Owen Mihalop (MCSM, BSc (Hons), MSc, FGS, MIMMM, CEng) is Chief Operating Officer for Cornish Metals Inc. and has sufficient experience relevant to the style of mineralisation and type of deposit under consideration and to the activity which he is undertaking to qualify as a Competent Person as defined under the JORC Code (2012) and as a Qualified Person under NI 43-101. Mr. Mihalop consents to the inclusion in this announcement of the matters based on his information in the form and context in which it appears.

For additional information please contact:

In North America:

Irene Dorsman at (604) 200 6664.

In UK:

SP Angel Corporate Finance LLP Tel: +44 203 470 0470

(Nominated Adviser & Joint Broker) Richard Morrison

Charlie Bouverat

Grant Barker

H & P Advisory Limited Tel: +44 207 907 8500

(Joint Broker) Matthew Hasson

Andrew Chubb

Ernest Bell

BlytheRay Tel: +44 207 138 3204

(Financial PR/IR-London) Tim Blythe tim.blythe@blytheray.com

Megan Ray megan.ray@blytheray.com

ON BEHALF OF THE BOARD OF DIRECTORS

“Richard D. Williams”

Richard D. Williams, P.Geo

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Caution regarding forward looking statements

This news release contains "forward-looking statements" including, but not limited to, statements in connection with the expected use of proceeds of the Offering, including in respect of certain work programs, expected construction, including in respect of the WTP, and the potential completion of a Feasibility Study on the South Crofty mine and the timing thereof, the exploration program at United Downs and other exploration opportunities surrounding the South Crofty tin project, expected recruitment of various personnel, and expectations respecting tin pricing and other economic factors. Forward-looking statements, while based on management’s best estimates and assumptions at the time such statements are made, are subject to risks and uncertainties that may cause actual results to be materially different from those expressed or implied by such forward-looking statements, including but not limited to: risks related to receipt of regulatory approvals, risks related to general economic and market conditions; risks related to the COVID-19 global pandemic and any variants of COVID-19 which may arise; risks related to the availability of financing when required and on terms acceptable to the Company and the potential consequences if the Company fails to obtain any such financing, such as a potential disruption of the Company’s exploration program(s); the timing and content of upcoming work programs; actual results of proposed exploration activities; possible variations in Mineral Resources or grade; failure of plant, equipment or processes to operate as anticipated; accidents, labour disputes, title disputes, claims and limitations on insurance coverage and other risks of the mining industry; changes in national and local government regulation of mining operations, tax rules and regulations.

Although Cornish Metals has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking statements, there may be other factors that cause results not to be as anticipated, estimated or intended. There can be no assurance that such statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking statements. Cornish Metals undertakes no obligation or responsibility to update forward-looking statements, except as required by law.

Market Abuse Regulation (MAR) Disclosure

The information contained within this announcement is deemed by the Company to constitute inside information pursuant to Article 7 of EU Regulation 596/2014 as it forms part of UK domestic law by virtue of the European Union (Withdrawal) Act 2018 as amended.