Related Document

Cornish Metals Inc. (TSX-V/AIM: CUSN) (“Cornish Metals” or the “Company”), a mineral exploration and development company focused on its projects in Cornwall, United Kingdom, is pleased to announce that it has released its unaudited financial statements and management’s discussion and analysis (“MD&A”) for the nine months ended October 31, 2021. The reports are available under the Company’s profile on SEDAR (www.sedar.com) and on the Company’s website.

Highlights for the nine months ended October 31, 2021 and for the period ending December 15, 2021

(All figures expressed in Canadian dollars unless otherwise stated)

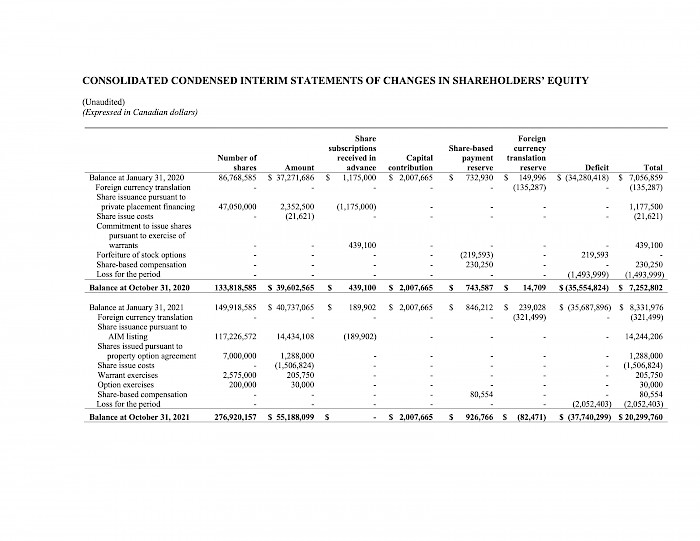

- Completion of listing and concurrent financing on AIM in February 2021 raising gross proceeds of £8.2 million ($14.4 million based on closest available exchange rate) to advance the United Downs exploration project and for general working capital purposes (news release dated Feb. 15, 2021);

- Conversion of Osisko loan note in February 2021 into two royalty agreements over mineral properties in Cornwall with an accompanying simplified and reduced security package (news release dated Feb. 22, 2021);

- Agreements reached for the leasing of additional mineral rights at the South Crofty tin project and surface land surrounding the New Roskear Shaft, and binding heads of terms agreed for the disposal of waste material derived from the dewatering of the South Crofty mine (news release dated March 8, 2021);

- Increases in Indicated Resource and Inferred JORC (2012) Compliant Resource of contained tin / tin equivalent by 10.2% and 129.8%, respectively, for the Lower Mine in an updated Mineral Resource Estimate for South Crofty Mine published in June 2021 (news release dated June 9, 2021);

- Commencement of phased exploration program at the United Downs exploration project in April 2021 with results from first 3,927 meters of drilling reported to date, with a further 4,000 to 5,000 meters of drilling planned under the program (news releases dated July 5, 2021, August 30, 2021, Nov. 3, 2021 and Dec. 6, 2021);

- Agreement reached for the restructuring of outstanding deferred consideration relating to the acquisition of the South Crofty tin project and associated mineral rights (news release dated July 1, 2021);

- Financing options continue to be considered to progress the South Crofty tin project; and

- Mr. Stephen Gatley appointed as an independent non-executive Director to the Board in October 2021 (news release dated Oct. 13, 2021).

Richard Williams, CEO of Cornish Metals, stated, “In the last few months, the ongoing exploration program at United Downs has delivered promising results validating the exploration potential we believe exists within our mineral properties. We look forward to reporting further results of the exploration program in the coming months.

I am pleased that during the period we obtained regulatory approval for the restructuring of the deferred consideration payable in respect of the acquisition of the Cornwall mineral properties which provides greater certainty for all parties. Steve Gatley joining the board also provided added strong mining and mine building expertise to the Company.

With the backdrop of record high tin prices, recognition of tin’s importance to electrification of the economy and new renewable power generation initiatives, and the importance of domestic and responsible supply of minerals, we continue to assess various financing options to progress South Crofty. We concur with market analysis that the increasing demand for tin seen against supply restraints shows no sign of abating in the near to medium term.”

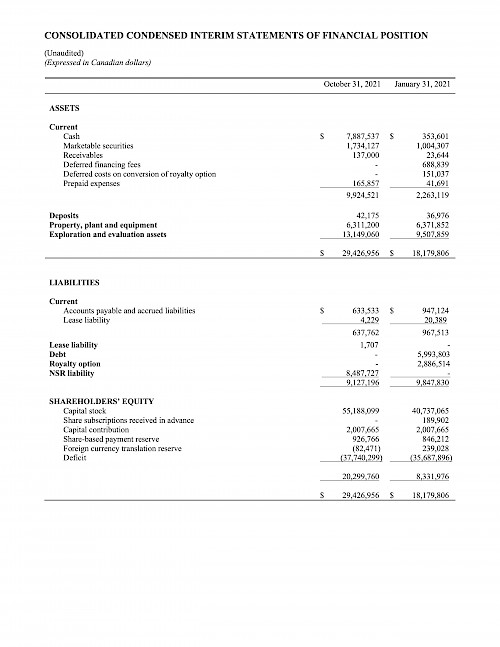

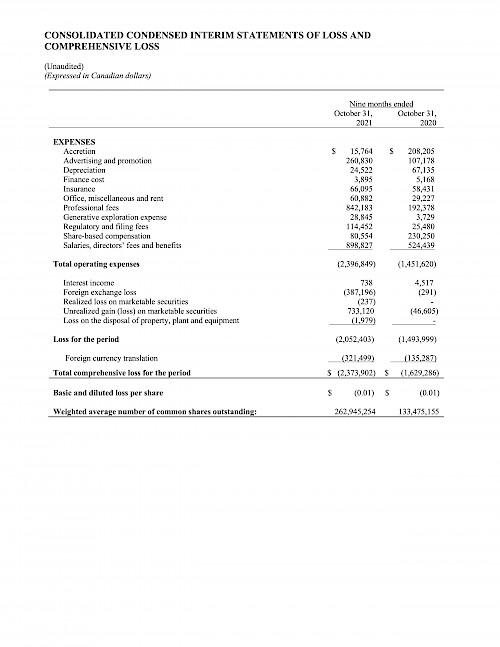

Financial highlights for the nine months ended October 31, 2021

|

|

Nine months ended (unaudited) |

|

|

(Expressed in Canadian dollars) |

October 31, 2021 |

October 31, 2020 |

|

|

|

|

|

Total operating expenses |

2,396,849 |

1,451,620 |

|

Loss for the period |

2,052,403 |

1,493,999 |

|

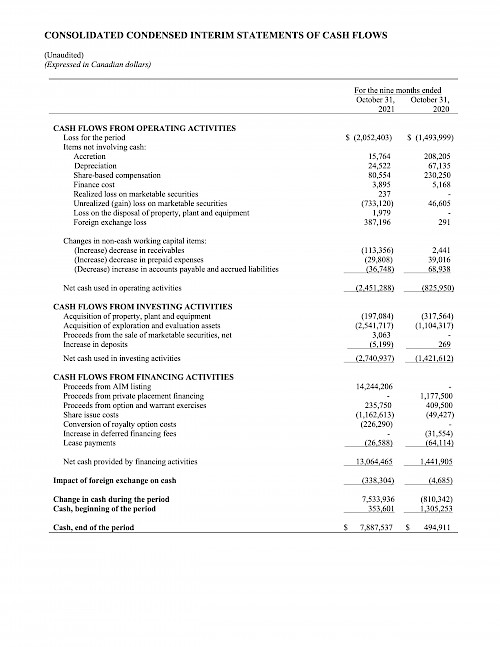

Net cash used in operating activities |

2,451,288 |

825,950 |

|

Net cash used in investing activities |

2,740,937 |

1,421,612 |

|

Net cash provided by financing activities |

13,064,465 |

1,441,905 |

|

Cash at end of the financial period |

7,887,537 |

494,911 |

- Increase in operating expenses impacted by $368,325 of costs relating to AIM listing not eligible for capitalization;

- Higher advisory costs incurred more generally relating to AIM listing and corporate initiatives, offset by reduction in operating expenses arising from closure of Vancouver office in April 2021;

- Unrealized gain of $733,120 arising from increased valuation of Company’s holding in Cornish Lithium following its fundraising completed in July 2021;

- Costs of $1,586,277 capitalized in connection with the ongoing exploration program at United Downs (excluding capitalized depreciation and foreign exchange movements); and

- Gross proceeds raised from AIM listing of $14.2 million (£8.2 million) with share issue costs of $1.5 million.

Outlook

The proceeds from the recently completed AIM listing are being used to conduct a drill program at the United Downs exploration project, to conduct initial field work on other high priority exploration targets within transport distance of South Crofty, and for general working capital purposes. Management believes that, subject to drilling success, the proceeds from the AIM listing will result in the Company being fully funded to the completion of a maiden JORC resource at the United Downs exploration project.

Within 12 to 18 months of the date of the AIM listing, the Company plans are as follows:

- Continue with the 18 month 9,100 meter initial drilling program at United Downs to advance the project to JORC Compliant Inferred Mineral Resource definition, fully funded from the proceeds arising from the AIM listing. To date, a total of 3,927 meters have been reported;

- Continue drill testing three lodes with a 1,000 meter of strike length to a depth of 500 meters in the initial phase. Management believes there are up to seven further mineralized lode structures with a total resource potential of between four million tonnes and ten million tonnes;

- Subject to the outcome of the initial drilling program, to undertake a subsequent in-fill drilling program at United Downs to advance the project to a feasibility study within three years; and

- Evaluate other near-surface, high potential, exploration targets within transport distance of the planned processing plant site.

In the longer term, the Company intends to develop the South Crofty tin project as and when economic conditions and cashflows are supportive.

ABOUT CORNISH METALS

Cornish Metals completed the acquisition of the South Crofty tin and United Downs copper / tin projects, plus additional mineral rights located in Cornwall, UK, in July 2016 (see Company news release dated July 12, 2016). The additional mineral rights cover an area of approximately 15,000 hectares and are distributed throughout Cornwall. Some of these mineral rights cover old mines that were historically worked for copper, tin, zinc, and tungsten.

For additional information please contact:

In North America:

Irene Dorsman at (604) 200 6664.

SP Angel Corporate Finance LLP Tel: +44 203 470 0470

(Nominated Adviser & Joint Broker) Richard Morrison

Charlie Bouverat

Grant Barker

H & P Advisory Limited Tel: +44 207 907 8500

(Joint Broker) Matthew Hasson

Andrew Chubb

Ernest Bell

Blytheweigh Tel: +44 207 138 3204

(Financial PR/IR-London) Tim Blythe

Megan Ray

ON BEHALF OF THE BOARD OF DIRECTORS

“Richard D. Williams”

Richard D. Williams, P.Geo

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Caution regarding forward looking statements

This news release contains "forward-looking statements". Forward-looking statements, while based on management's best estimates and assumptions at the time such statements are made, are subject to risks and uncertainties that may cause actual results to be materially different from those expressed or implied by such forward-looking statements, including but not limited to: risks related to receipt of regulatory approvals, risks related to general economic and market conditions; risks related to the COVID-19 global pandemic and any variants of COVID-19 which may arise; risks related to the availability of financing; the timing and content of upcoming work programs; actual results of proposed exploration activities; possible variations in Mineral Resources or grade; failure of plant, equipment or processes to operate as anticipated; accidents, labour disputes, title disputes, claims and limitations on insurance coverage and other risks of the mining industry; changes in national and local government regulation of mining operations, tax rules and regulations.

Although Cornish Metals has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking statements, there may be other factors that cause results not to be as anticipated, estimated or intended. There can be no assurance that such statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking statements. Cornish Metals undertakes no obligation or responsibility to update forward-looking statements, except as required by law.

Market Abuse Regulation (MAR) Disclosure

The information contained within this announcement is deemed by the Company to constitute inside information pursuant to Article 7 of EU Regulation 596/2014 as it forms part of UK domestic law by virtue of the European Union (Withdrawal) Act 2018 as amended.